TL;DR: The insurance industry is a highly competitive, high CAC, high LTV sector where customer retention is key. Customer attrition has a negative impact on immediate revenue, but also on brand reputation, growth perspectives and momentum. When delivering a customer retention strategy, the industry starts identifying and addressing what are the main drivers of churning. There are different narratives around what those are, but we can mention friction with the service, pricing and aggressive acquisition efforts from competitors as the main ones. We go through several misconceptions around churning and how it is approached by insurers. One is that customer attrition is not always a bad thing perse, what are the cases and when to pay attention. The second one being what to do when you cannot easily change the product. We close the article with some lessons and insights from the insurance industry that can be applied to our process to develop an effective customer retention strategy.

Full Version

The insurance industry is particularly tricky. Ask around and most people find it boring and unappealing. It is, though, one of the most interesting businesses around. It is not only a phenomenal business but one with numerous intricacies. It is a complex environment, with ruthless competition. It also happens to have one of the highest costs of customer acquisition.

As a sector, it is one of the top advertisers by spending in Google Adwords (7.7 Billion investment in 2018, according to Statista). On top of that, it has plenty of talented people doing their best! On the surface is a stagnant sector that moves slowly and is waiting to be disrupted. Lots of incumbents and new players pop up every day trying to get a slice of the pie, meaning if you scratch the surface, you find lots of interesting ways to compete. Saas and insurance work in similar ways, they operate replacing their churned customers with new ones. It doesn’t make economic sense though it is an accepted practice.

For the next pieces, I wanted to start with the insurance sector and their churn rate vector. I am familiar with the traditional insurance industry, but not so much about how insurtech is addressing retention. It seems interesting to focus and research it deeper down the road. I love the thrill of unravelling complexity hidden under a simpler shape. This will be written as a series and might need further corrections later, so bear with me, please.

On the other hand, there are lots of takeaways that can be useful for different industries if applied. I believe some concepts can be extrapolated to your own business. Approaches and ideas can be replicated successfully in different areas or markets. That is the goal of this series and I’d like you to read it like that in mind. “What can I take from this that would make my SaaS company stronger?”.

My whole point is that churning is hard to grasp a problem. Sometimes, for different reasons, teams struggle to strategize around it. Something that helps is reframing it instrumental for the health of the business. Churning is key to the health of the company, that is a hill I am willing to die on. That and the need of putting it in the context for your marketing efforts.

The more we learn about how customer retention is framed in different industries, the better we will be able to create a churn reduction strategy for our Saas.

Reframing Churn rate

The insurance industry is (sometimes infamously) known for high CAC (Customer Acquisition Cost). Assuming the impact on costs is equally distributed among policyholders, the revenue will be directly tied to the churning or retention of said group of customers. Acquiring customers that remain as such and with a profile that has the lower possible cost towards the company is key for the sector.

In simple words. The longer the customer sticks with the company, the more money it generates. The better the client is in terms of health/life expectancy/accident rates, the better. In that sense, not all acquisition channels are equal. We know that some marketing channels bring clients with a healthier profile than others, a higher LTV. In the same way, we attach revenue or accident rate to acquisition channels, we should add churning rate to our marketing reports.

Why are most teams reluctant to do it? because there is a lack of control on the churning. It is perceived as a metric hard to leverage. Hard to change, hard to own. I’ll build my case, the need to include it, around the belief that with a proper frame it can be effectively reduced. So how is the retention addressed in the insurance industry? What are some of its side effects and what can be done about it?

The slow bleeding, effects of a high Churn rate

What does it mean for a company to have a high churn rate? The first thing that comes to mind is the impact on revenue. The immediate effect is the loss of a chunk of the profits that said user would provide in the short term.

Taking a wider perspective, there are second-order effects. Brand reputation is taking a hit. Even if the drop was not a direct consequence of a negligent service to the customer. The simple fact that said customer decided to opt-out from our product is detrimental to our brand positioning in the majority of the cases.

Finally, moving away from the immediate impact, customers churning hinder the growth of your business in the long run. Moreover in the case of the insurance industry. It is true that the longer the customer sticks to the brand, the higher the odds of becoming a cost to the insurance company, making it necessary to have accurate models of customer cycles. Said that, the insurance client is potentially a source of pure revenue, indefinitely. Think about it, constant fuel to your machine, without any cost. It is revenue that otherwise will end up helping a competitor grow.

In summary, losing immediate revenue, more than probably getting a negative brand reputation in the short term. In the long term a risk of losing momentum, faltering growth.

Usual suspects, churning triggers

In a sense, the insurance industry is not different from other subscription-based businesses. Part of developing a successful customer retention strategy would have to pass necessarily through identifying the drivers of churn. What is causing my customer base to churn? How to structure and group those is a different story.

We recommend surveying customers on their way out. Our solution triggers an exit survey asking customers to provide a reason for their cancellation intent, but there are multiple solutions or in-house implementations that can be applied. Customer interviews with already churned ones might provide even deeper insights into those very reasons.

There are a couple of key questions that can be asked in order to help with this part of the process.

First, what are the main reasons and how can I score them in terms of “How difficult would it be to tackle this?”.

The second question that you might want to answer is “How much of my churning is passive, how much of it is active and how much is delinquency?”.

Some definitions

We consider passive churning when the customer decides consciously not to extend their contract with our SaaS. Active churn is when there is a proactive decision to terminate the contract, either because of a change in the customer situation or as a result of a friction with our product. Delinquency is when we need to end the relationship with the customer because we are not able to charge the card on file. The reasons for delinquency range from expired cards, frozen payments, credit being maxed out, etc.

There are multiple ways to fight it (shameless auto promo: we are developing some custom dunning solutions to help our clients address it as well, just reply and let me know if you want to beta-test those for free before anyone else).

Main causes for their customer attrition

Back to the insurance industry, there are multiple industry-specific studies around the main causes for their customer attrition. According to those, there are three main drivers for churning. Please, before continuing, take it with a grain of salt and always do your research. I am doing my best to summarize a very vast industry landscape with its nuances and diversity in products and situations.

The first one would be having issues with the policy payout. Customers are naturally motivated to stop working with the company if they experience issues when they need their insurance company to come forward and step up their game the most. Historically some players in the industry gained a bad reputation because of this. I want to think that by the basic nature of the issue. There is an apparent lack of incentive to reduce the red tape around claim resolutions. In a nugget, friction with the product provided.

The second would be pricing. In a market seriously obfuscated, where the information is imperfect and fragmented, a fair and competitive price is a serious driver to retention. This fact somehow fits with the third factor, other companies' aggressive acquisition strategies.

Regarding this, there is an exercise we have applied successfully in the past, that can be used in any other industry. It is a process. In the first part, we identify what are the key drivers for user satisfaction for our product. In the second we give ourselves a score for each point. Lastly, we validate with real present/past customers. How do they rank us for each point? With this we identify what are the gaps between our perception and reality. That should provide enough data to start informing our customer retention strategy.

(Some) Things people get wrong about churning

What are some things about churning that (some) people get wrong and how it applies to the insurance industry?

Not all customer churning is the same

In the same way not all customer acquisition efforts work the same. You want to have a good picture of the customers wanting to leave. Knowing what are the patterns and segments you can divide the customers leaving will allow you to apply different levels of granularity in your efforts recovering them. It also will guide your retention strategy and point out where you should lean in first. If you are an insurer facing a big proportion of your customers churning on a monthly basis, you want to check their risk profile. If the majority of them fall into a high-risk group, it would be less of a problem than if they are in your premium segments.

Having high customer retention is not always a bad thing

The perfect example of this is a well-known secret between marketeers. A high churning is the B side of a successful acquisition strategy. There are two valid scenarios where this turns out to be true.

The first one is during the first exploratory stages of a new marketing strategy. You are expanding your acquisition channels and are not yet totally sure what leads will become long term customers. It is perfectly fine to assume there will be a part that churn. Actually, if there is not a significant proportion of that happening, it might be your team is not being aggressive enough.

A second scenario is a situation where your marketing is being highly successful. Given the team keeping the CAC below the thresholds, there is an unavoidable % of new users that will eventually drop. The actions are performing “too good”, but as far as you move between your original parameters, it is okay to attract a less committed crowd. There will be time to adjust down the road the budgets or segments to target. It is a nice-to-have situation.

It might also mean you are struggling to scale things up and your onboarding experience is being less than amazing. The org tallied up erroneously the capacity needed to absorb the new leads. It is paramount to take rapid action and fix or scale up the stressed parts, but again, a cool problem to deal with.

If you cannot change the product, change the perception of it

There are situations where changing your product is not entirely possible. At least not at the speed we’d like to. In those cases, there are always options. You can say something of the sorts of “If I cannot change this, what else is in my hands?”. For insurers, the product is pretty complex and usually hard to change. There are core vectors of the product itself that are pretty much monolithic.

It is very unlikely that any insurer can modify the economics of the policies or the nature of the legit claims. It is possible though to modify the perception of the different interactions the client has. Some vectors of the product are even more important than pure insurance. Consider your product in a holistic way, including every possible interaction with your customer base. As an example, some insurers have seen a reduction in their churn rate by ensuring all the customer interactions are always routed to the same agent. The product itself is the same, but by changing the perception of the experience, they enhance the value.

But seriously, change the product

No customer retention strategy survives a product/experience flawed at its core. If your churn reduction strategy or plan does not include bringing those insights to the table and impacting your product or service roadmap, there is something that needs to be improved. Being bold and facing changes that others consider insurmountable is what in the long run brings real competitive advantages.

Developing a customer retention strategy

what can be learn from the insurance industry

Let’s review some things we can learn and apply from the insurance industry.

Give churning the focus it deserves

If you have read this far, you might not need to be reminded of this, but anyway, put your churning rate at the same level as your other key metrics. The economics of your Saas depends on it as much as it does in your acquisition metrics.

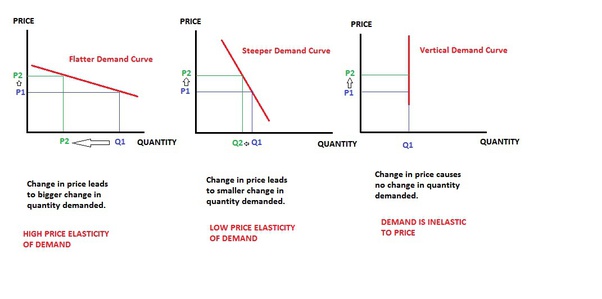

Work your pricing out

Pricing is a core element of your value proposition. Not only defines the segment you are targeting, but it also changes the perceived value of your product. A fair, competitive price might help your customers stay, but also might attract the wrong crowd. Price too low and you might drive down your returns to an unsustainable point. Price too high and you drag down your conversion rate.

There are complex dynamics operating behind your Saas pricing. In doubt, follow Patrick McKenzie's advice and raise your prices (aka @patio11).

Finding the perfect price point is a complex science (we might give some space to it in the newsletter in the future). The lesson here is to devote some time to find out what is the sweet spot for your brand. Do your due diligence, research other players in the field or equivalent solutions, run your experiments and remember it is a moving targets

Improve your positioning

You need to go beyond the average customer retention program, work with your positioning. According to one piece of research from coverage.com, “Other important factors include friendly, seamless user experience and a policyholder’s trust in their insurer’s organization”. In the same way, your brand does work to your favour as an element of retention. Particularly if your Saas operates in an undifferentiated market. Among a seamless equal range of offering, the stronger your brand is, the higher your retention correlates.

On brand positioning I always recommend April Dunford’s “Obviously awesome: How to Nail Product Positioning So Customers Get It, Buy It, Love It” and “Positioning: The Battle for Your Mind” by Al Reis and Jack Trout

Define the key factors that drive customer satisfaction

Find out what are the key elements of your user satisfaction. What makes your user happy and have a clear idea of how you are delivering value. Double down into that. Find the gaps, fix those.

Fencing with multiple anchors

In 2015, a McKinsey report found that "existing customers are 2.5 times more likely to buy additional products within 12 months of their initial purchase and twice as likely to return to the same carrier". Find ways to provide more value over time. Add layers, give your customers reasons to stay.

1-single-agent and “quick lanes”

Moving from a scenery where the customer has to deal with numerous agents to a single POC increases the retention. In the same way, some insurers apply what we know as quickly lanes. On qualified claims, the pay policy proceeds faster to help maintain a good relationship with the client.

The takeaway here is to think about your product as a holistic experience. Including every possible interaction and understanding how it can be improved potentially has a positive effect in your retention.

Discounted bundling

Insurance companies increase their retention rates by offering discounted bundling. If you acquire more than one policy, you get a discount rate. On one side it provides more revenue to the business, on the other hand, it adds complexity to a potential disengagement from the company. Ergo, increasing the retention rate. A win-win.

Asymmetrical application of your resources

Segment and apply your resources in a more efficient way. It does not have to be a challenging process. Any business has an asymmetric distribution in its customer base. Being it in terms of returns, support needs, feature demands, etc. Find out who falls into your top 20% and allocate your resources around that segment. I am not talking about neglecting your user base. I am talking about doing things that do not scale, for the group of users that brings more revenue home. The happier they are, the more likely that specific group might attract likewise customers.

Invest in personalization (accolade example)

Examples in the insurance industry are highly customized policies that tie the insured, as there are literally no other players in the market that would provide such level of personalization. Not exactly in the insurance sector, but somehow related, I like the case of Accolade. Accolade is a great example of how applying personalization and customization to disrupt a huge sector like health care is.

Give your customer as many channels as possible

The insurance product relies heavily on interaction with the customer. It is a key part of their experience. They reduce their churning by providing as many communication channels as possible. By allowing the customer to perform their interactions using what is already familiar or more convenient for them, insurers improve automatically the experience and the perceived value of their product.